The increasing financial burden of healthcare is putting many Americans in a tight spot. A recent survey reveals the challenges individuals face in paying their medical bills, suggesting a deep-seated problem that extends beyond mere affordability.

A Comprehensive Study

A 2024 Healthcare Financial Experience Study conducted by Cedar delves into the reasons why Americans find it challenging to pay their medical bills.

Survey Demographics

Over 1,200 U.S. adults aged 26 and above participated, all responsible for healthcare decisions and bill payments for themselves or dependents.

The Affordability Crisis

According to the survey, 72% identify affordability as the main obstacle to settling medical bills, with 48% experiencing an increase in healthcare costs over the past year.

Widespread Financial Anxiety

Nearly 59% of participants expressed concerns about affording their medical expenses in the coming year.

Threshold for Surprise Bills

23% of respondents could not afford an unexpected medical bill exceeding $250, and 15% could not handle any unforeseen medical costs.

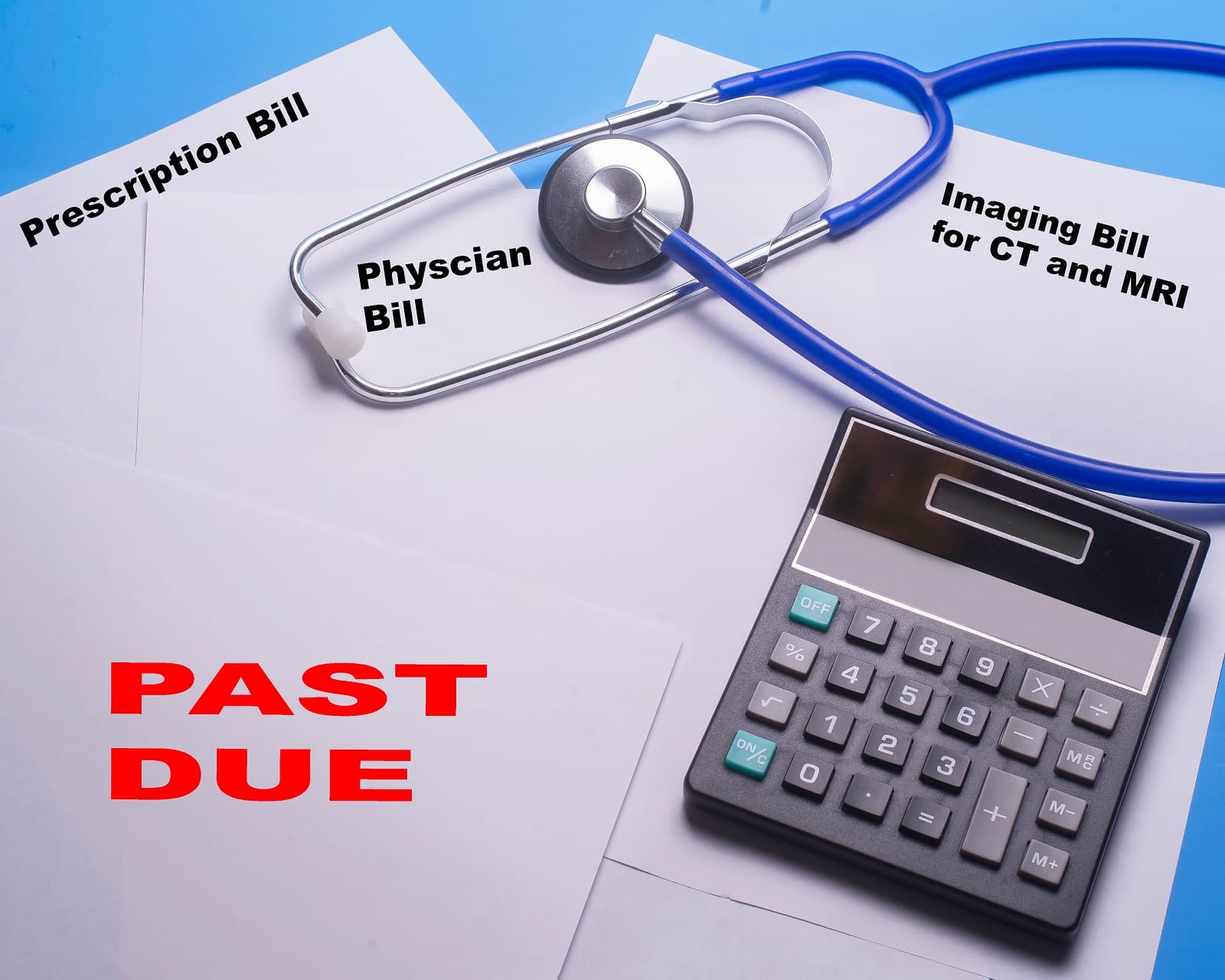

Inability to Pay

One-fifth of the participants confessed to having unpaid medical bills simply due to their inability to afford them.

Unpaid Bills and Collections

25% of respondents had unpaid medical bills sent to collections, revealing the extent of the financial strain.

Health and Well-Being Impact

Nearly half noted that difficulties in paying medical bills had a negative impact on their health and well-being.

Stressful Billing Process

58% found the act of paying medical bills stressful, while 55% felt stressed trying to understand their dues.

Payment Coordination Issues

37% found reconciling billing issues between providers and insurers extremely stressful, emphasizing the need for improved communication.

Provider and Insurer Satisfaction

78% considered payment coordination a vital factor in insurer satisfaction, and 69% said it would influence provider recommendations.

Feeling Out of Control

A third of respondents felt they lacked control over their healthcare finances.

Confusion Over Bills

31% found it hard to understand their healthcare benefits and bills, with 23% finding the process stressful.

Non-payment Due to Confusion

40% would refrain from paying if they were confused about coverage or payment methods, and 28% delayed payment due to confusion.

Seeking Better Pricing

Half of the respondents indicated that having a cost estimate beforehand would encourage them to seek better pricing.

Unaware of Financial Aid

63% were uncertain about available financial aid options, with only 36% using financial assistance.

Reluctance and Lack of Access

52% felt uncomfortable accepting assistance, while 13% couldn’t pay a bill due to a lack of financial aid options.

Openness to Payment Plans

73% expressed willingness to utilize payment plans or financing options to manage large bills.

Discounts Influence Provider Choice

57% stated that a provider’s discount options would influence their decision to use their services.

Leveraging Technology for Assistance

The study suggests that healthcare providers could use digital tools to improve access to financial aid, making the process less cumbersome for both patients and staff.

An Urgent Need for Change

The results emphasize the necessity for systemic changes to alleviate Americans’ financial burden and stress in managing healthcare costs, highlighting opportunities for providers to step in and offer solutions.

The post Americans Fight Back: Medical Debt Crisis Sparks Reform Demands first appeared on Career Step Up.

Featured Image Credit: Shutterstock / Sheila Fitzgerald.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.