Another high-profile financial figure has stepped forward to warn about the potential impacts of the US trillion-dollar national debt.

Cooperman Speaks Out

The US is being nudged ever closer to a financial crisis as a result of trillion-dollar debt, according to billionaire investor Leon Cooperman.

Interview With CNBC

In an interview with CNBC on Tuesday, the CEO of the Omega Family Office pointed to “a leadership crisis” that had caused the mounting national debt which he predicted would boil over into a financial crisis.

“A Leadership Crisis”

“I think we have a system of leadership in this country that’s evolved to a leadership crisis,” he explained. “Deficits matter, and I think we’re headed into a financial crisis in this country.”

Trillion Dollar Debt

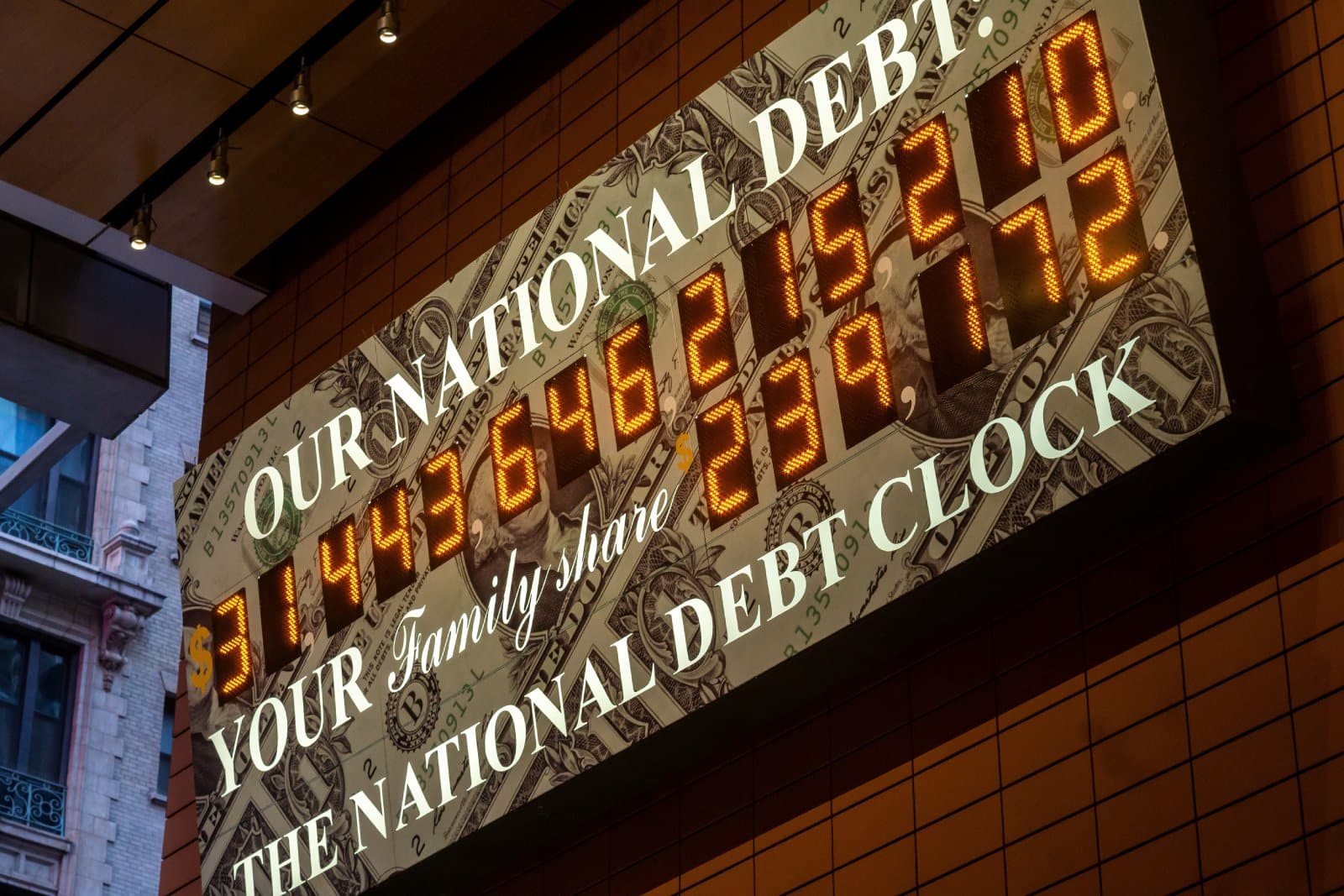

US debt currently sits at over $34 trillion, a figure that has caused widespread concern amongst leading figures in the banking and finance industries.

Not Enough Being Done

Cooperman pointed out that very little has been done by subsequent governments to slash debt in the last decade. The last notable anti-debt move from the White House occurred under Barack Obama in 2010.

The Simpson-Bowles Commission

This was the Simpson-Bowles Commission, a commission on ‘Fiscal Responsibility and Reform’ which focused on strategies for deficit reduction, and improving “the fiscal situation in the medium term and to achieve fiscal sustainability over the long run.”

Lack of Action from Successive Presidents

Since then, Cooperman claims that no other presidents have worked meaningfully toward addressing the problems by the commission.

Criticizing the Fed

He also pointed to recent monetary policy decisions by the Federal Reserve, particularly the decision to raise interest rates by more than 500 basis points in a single year, after a decade of keeping interest rates near zero.

“The Fed Is Too Restrictive”

“Now they’re talking about cutting rates, and the Fed is too restrictive,” Cooperman continued. “There’s no sign that I could tell from the economy and the market that the Fed is restrictive.”

Giving It a “Low Grade”

He even went as far as to give the Fed a “low grade” for the central bank’s approach to monetary policy.

Overvalued Stocks, Too Much Speculation

The investor also pointed to excessive speculation in the markets, which had led to them being overvalued, suggesting that a steep decline could be in store for investors.

Warnings Since February

Cooperman is a consistently bearish investor, even warning as far back as February that markets were overvalued and predicting a downturn.

Another Pessimistic Prediction

It is just the latest of Coopermans more pessimistic predictions for the US economy. Last year in May he described the economic situation in the US as a “textbook” financial crisis in an interview with Bloomberg.

Last Years Problems

The billionaire CEO pointed to the Silicon Valley Bank’s failure as a major cause of market volatility at the time, leaving the US banking sector shaken up.

Recession and Investing Warnings

He also warned of an incoming recession, very poor returns for stocks, and long-term lows for the S&P 500.

“A Self-Induced Crisis”

“It’s kind of like textbook,” he told Bloomberg. “We have a self-induced crisis by irresponsible fiscal and monetary policy [over] the last decade. I did not forecast the [SVB] issue, but I did have a view that we were heading into a crisis of some kind, and we’re seeing it.”

Two Decades With Goldman Sachs

Cooperman has a long history in the US financial industries, working at multinational investment bank Goldman Sachs for 22 years, where he won awards as a portfolio strategist. He then left Goldman to start a private investment partnership, Omega Advisors, Inc., which he then converted into a family office.

Plenty of Others Chime In

The investor is far from the only high-profile financial figure to draw attention to the concerning level of national debt in recent times.

The US “Most Predictable Crisis”

Earlier this year JP Morgan Chase CEO Jamie Dimon called US debt the “most predictable crisis” in US history, that could have “potentially disastrous outcomes.”

Debt Problems and Spirals

Risk analyst, mathematician, and author of The Black Swan Nassim Taleb also warned of an economic “death spiral”, and Bank of America CEO Brian Moynihan has also remarked that it’s time to do something about the US “debt problem.”

The post – U.S. on Brink of Debt-Induced Financial Crisis According to Billionaire Leon Cooperman – first appeared on Career Step Up.

Featured Image Credit: Shutterstock / Salivanchuk Semen.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.