Target announced plans to end personal check payments at their checkouts, feeding into the ongoing decline of paper check use in the US.

Closing the Door on Check Payments

For decades writing checks was a part of everyday life and finances for Americans – now, digital payments are the norm, and one major retail chain is closing the door on personal checks for good.

No Longer Accepting Checks

Target Corp. confirmed that its chain stores will no longer accept personal checks as a form of payment from shoppers.

Ended July 15

The new payment policy came into effect on July 15, just a couple of days after the retail chain’s Red Circle week sale.

After the Red Circle Week

The Red Circle Week is one of the biggest events of Target’s calendar year, offering significant online and in-store sales relevant to nearly 2,000 stores across the country.

Streamlining Plan

In a public statement, the company confirmed that the decision was part of a plan to streamline the checkout process for customers, making it more simple and convenient.

“Extremely Low Volumes” of Check Payments

Personal checks are now being used in “extremely low volumes,” according to the company statement, so discontinuing the payment option seemed like a natural choice. Target will enact a number of measures to make sure customers know that personal check payments will no longer be available.

Available Options

From now on Target checkout payment options will include cash; digital wallet payments; credit/debit cards; buy now, pay later; and SNAP/EBT.

Decline of the Check

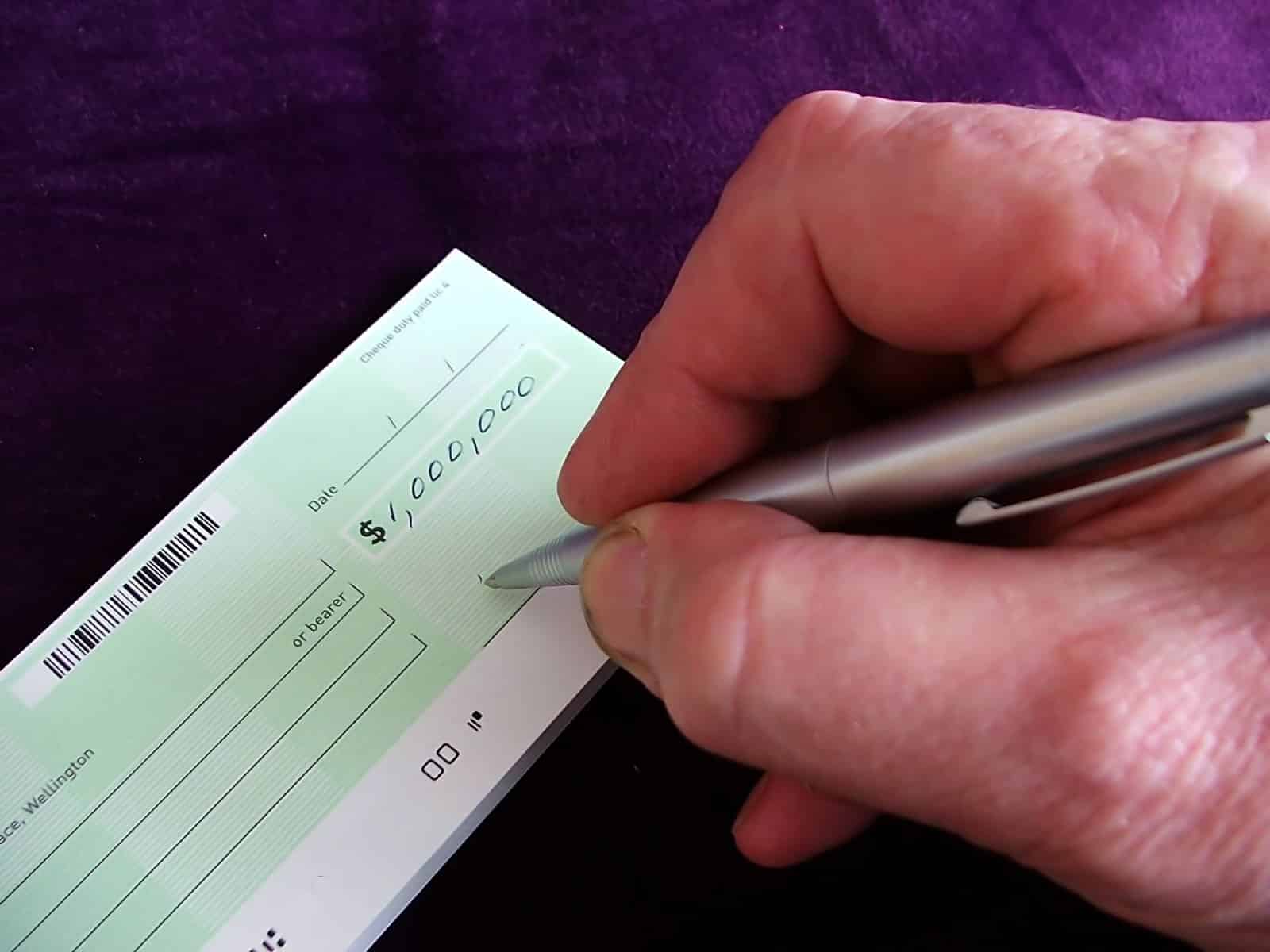

The announcement will not come as a surprise to shoppers, as the use of personal checks is falling across the board. A 2024 survey by finance software and consulting service Abrigo shows that only 61% of Americans wrote a check in the last year.

Big Change Over 15 Years

This is in stark contrast to data from the Federal Reserve Bank of Atlanta, which showed that 9 out of 10 American consumers wrote checks as a payment option back in 2009.

Digital Payments and Credit Cards

In those 15 years, the use of personal checks has been decimated, largely due to the rise of Eftpos/credit cards and digital payments like Venmo and PayPal.

Another Reason?

However, some experts suggest that the end of personal check payments at Target has less to do with “low volumes” and more to do with the growing problem of check fraud, which has skyrocketed in recent years.

Avoiding Rampant Check Fraud

“Consider us skeptical that the only reason Target is no longer accepting checks is because of ‘extremely low volume,’” said Teresa Murray of US PIRG, a non-profit consumer protections advocacy group. “Most likely, rampant check fraud concerns the company too. And that’s understandable.”

Other Companies Too

Target is far from the only high-visibility company to discontinue the payment option. Aldi’s and Whole Foods do not allow personal check payments either, with Whole Foods confirming that it makes the checkout process faster for everyone.

Some Retail Giants Hold Onto Checks

On the other hand, retail competitors like Walmart, Macy’s, and Kohl’s still accept personal checks at their registers. But it’s not hard to imagine them following in Target’s footsteps as the number of check users continues to dwindle.

Fed Data

Federal Reserve data also shows that only 3% of all payments in 2023 were made via personal check. 62% were made via credit and debit cards, and 16% were made with cash.

Declining Since the 90s

In fact, the decline of personal checks has been ongoing since the mid-90s. Checks are particularly obscure to the younger generations of Americans, many of whom will likely never write a check in their lifetime.

Older Demographics Only?

The use of paper checks is now heavily skewed toward older generations, with 15% of American consumers older than 69 years old claiming that they prefer to use checks to pay their bills, according to survey director Kevin Foster of the Atlanta Fed’s Research Division.

A Clear Trend

“The trend is clear: Older consumers prefer writing checks for bill payments more than their younger neighbors and family members,” Foster claimed.

Diminishing Infrastructure

This decline is also notable in the trends of US check-processing infrastructure. Back in 2003, the Fed operated 45 check-processing facilities across the country. Today, it operates just one.

Checks Aging Out

It looks likely that the use of written checks will be aged out of the US population, potentially ending with Baby Boomers and Gen X adults.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

Featured Image Credit: Shutterstock / BCFC.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.